Global Market Research 2021 – Top Findings

27th March 2022

There is no doubt that 2020 was one of the most challenging years for the market research industry. The recently published Global Market Research 2021 report created by ESOMAR demonstrates the impact of the Covid-19 pandemic on the market research sector in 2020.

We’ve put together a quick summary of this extensive report below.

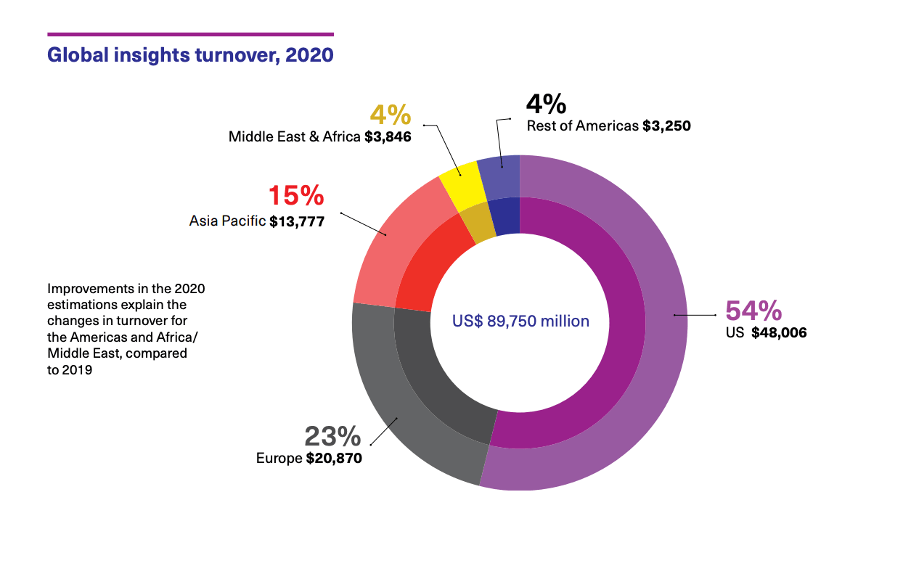

Global market research turnover grows by 0.3%

Although not as significant as seen in previous years, the global market saw a net growth of 0.3%. The factor contributing to positive growth was the technology sector with an estimated net growth of 8.4%.

The regions that reported positive levels of growth are the ones that responded most quickly to the pandemic and adapted to new circumstances the quickest by moving to remote methods of data gathering. The US took the lead with a net growth of 2.5%, followed by Europe with net growth of 1% and Asia Pacific which stayed flat.

Africa and Middle East saw a 10.4% decrease in net growth and the rest of the Americas a drop of up to 21.9% in net terms. Some of the factors contributing to the drop in net growth were extensive lockdowns, high infection rates, social discontent, inability to work as normal, difficulty to deploy online methodologies due to poor internet connection and lack of a skilled workforce.

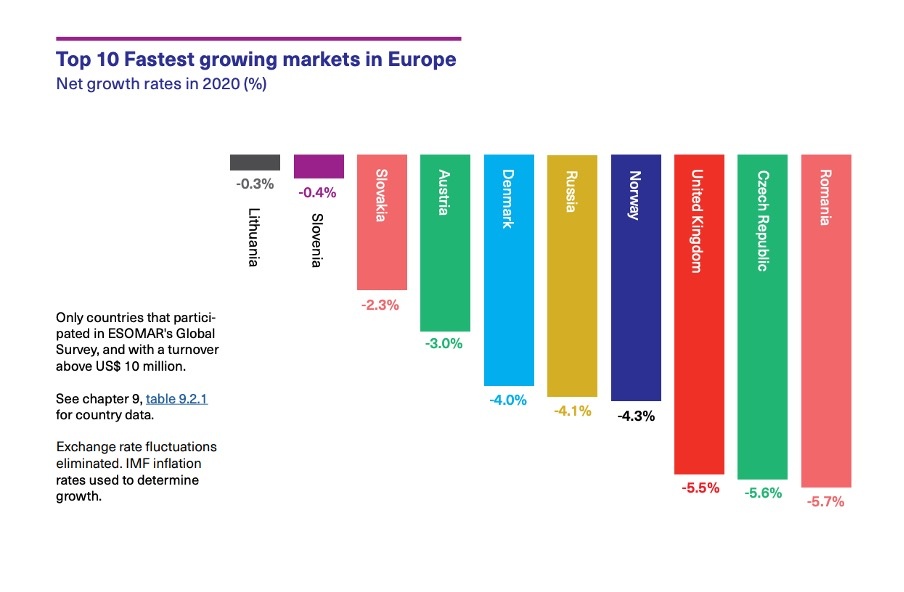

Europe’s growth saved by tech and reporting sectors

Europe’s growth levels mirror the turbulent performance of the global industry. The net growth of 1% was achieved thanks to the positive performance of tech-enabled and reporting sectors. The established industry was hit the most and reported a loss of 4.5% in net terms and value drop of more than half a billion US dollars. The gap left by established methods was filled by technology-enabled ones, which saw an increase of 12.5% (US $600 million). The reporting side of the industry which includes consultancy, industry reports and secondary analysis saw a decline of 2.5%.

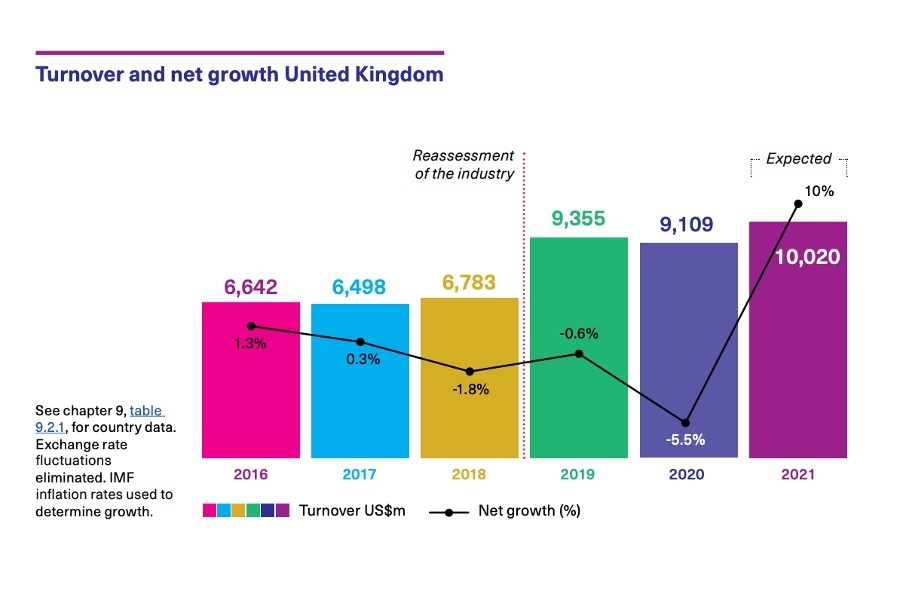

Market Research in the United Kingdom shows resilience and adaptability

The MRS estimates that the UK insight industry is worth more than £7,000,000,000 (US $9.1 billion), a 40% uplift on the previous estimate of GBP 5 billion. The growth was achieved by a strong workforce with at least 64,000 workers, in over 4,000 companies.

The UK market research industry responded better than expected to the impact of Brexit and the pandemic.

Last year it was feared the hit in revenue would circa -15% YOY, where in fact the current drop equals less than 5%.

The main strength of the UK research industry lies in the extensiveness and complexity of the supply chain, innovation and adaptability of UK businesses from face-to-face to online methods.

As a response to the Covid-19 pandemic, new methods and solutions were created to engage participants. These included adaptions to face-to-face research as well as use of online, mail and telephone methods.

An example, demonstrated in the MRS report, describes the ‘knock to nudge’ technique which uses behavioural science to influence participant behaviour. Participants were met on their doorstep and ‘nudged’ to either book an appointment or provide a telephone number.

The UK industry is utilising the opportunities created by the new methods of working during the pandemic to widen the offering of the UK research industry.

The industry adapted well to working from home, with a plan to continue a more hybrid mix of office and WFH in the future. As a result, more than 40% of both quantitative and qualitative data gathering is now online.

An expected 10% uplift in UK GDP is based on the positive recovery from Brexit and efficient response to the Covid-19 pandemic.

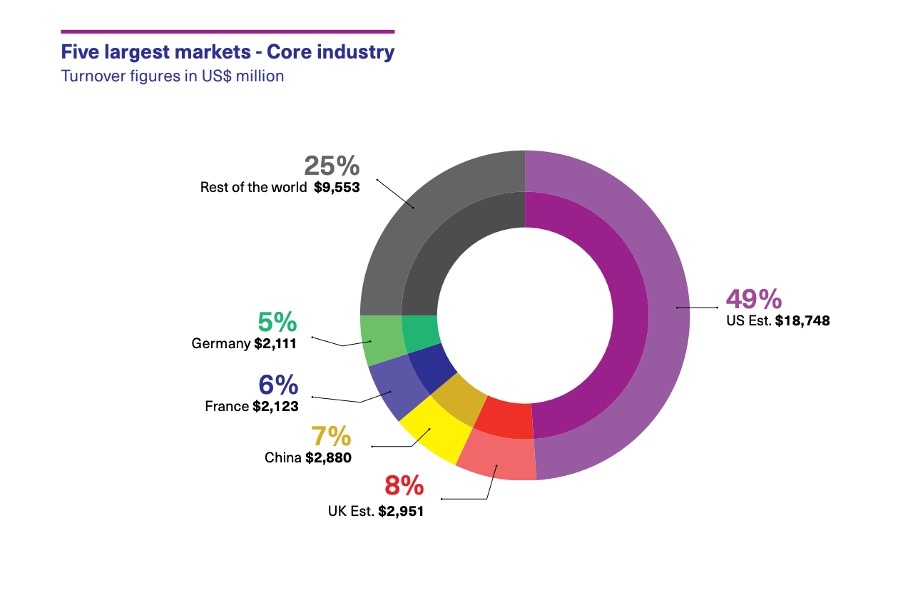

Five larger markets in 2020

The US continues to dominate with the largest market share of 49%, however this is down from 64% in 2019. As a result, the shares of the other countries have increased:

- Germany and UK’s share increased by 1%

- France and China’s share doubled

- Rest of the World share increased from 17% to 25%

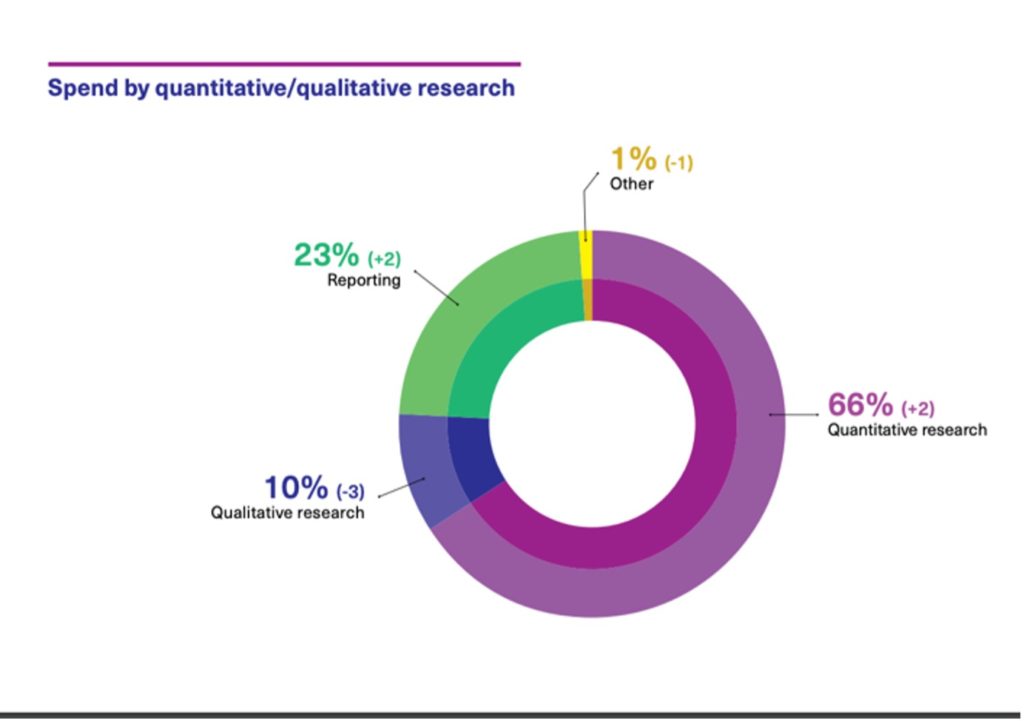

Spend by research type

Limitations of movement and a slowdown in the world’s economy led to an increase in share of quantitative research. The main factor behind this is that quantitative method is easier to implement online. We have also seen an increase in secondary research, which is part of reporting.

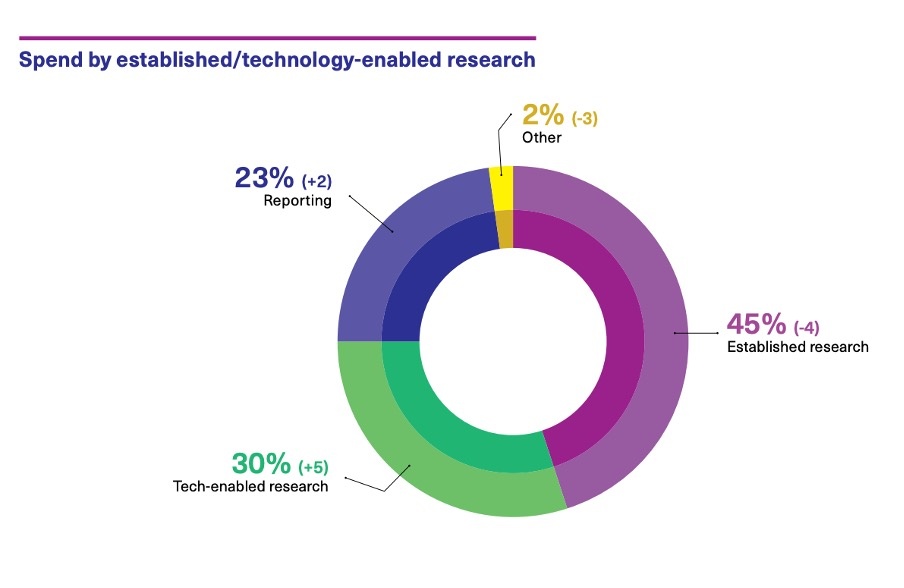

We have seen a shift from companies, once placed under the established sector, that have diversified into tech-enabled solutions in order to survive. As a result, the tech enabled sector has grown to 30% of the total research spend.

Summary

As we are entering the post-pandemic world, it’s clear that consumer behaviour, trust in politics and media, personal preferences and lifestyle habits have changed.

Have these factors changed consumers for good or are they just temporary glitches? I guess we need to wait for next year’s report to find out.

Foreign Tongues are the market research translation agency. We have provided translation and interpreting services to the market research industry for more than a quarter of a century. We provide the quote, with detailed cost breakdown, within 20 Minutes of receiving Client brief.

Submit your, free, no obligation Quote request here.